Aman is an NRI who resides in Dubai and works for KNZ Solution. He’s been saving hard for a long time. Now that he has accumulated a sizeable sum of money, he must decide whether to invest in Indian real estate or use mutual funds to access the Indian financial market. This is a dilemma that many Non-Resident Indians (NRIs)/(OCIs) encounter. Although both asset classes appear appealing, selecting the best option will rely on a number of aspects, such as risk, returns, liquidity, cost of transactions, and managerial in nature simplicity. The choice is more complex than ever in 2024 due to changing market dynamics. We’ll fairly evaluate each alternative in this blog and see which one may present NRIs with a better investing plan in 2024.

NRIs have been lured to Indian real estate for decades as a means of keeping ties to their home country. Property ownership is a sign of security, ancestry, and possible wealth growth in the long run. In 2024, with inflation, the world economy fluctuating, and India’s financial markets expanding, the dilemma of which investment choice should NRIs prioritize emerges. First, let’s comprehend the two of them.

Real Estate: Stability but High Entry Barriers:

Real estate has always been perceived as a “safe” investment for NRIs, with the emotional connection to owning property in their home country. For instance, NRIs in the UAE or the US often invest in cities like Mumbai or Bangalore, hoping for long-term gains.

According to a 2023 report by Knight Frank, real estate prices in India’s top cities grew by 5-10% last year.

The illiquidity of real estate is one of its main disadvantages. It can be difficult for NRIs to manage properties remotely, and selling a home might take months, particularly during a down market. Furthermore, transaction expenses including broking, stamp duty, and registration fees can severely reduce profits. For instance, an NRI investing ₹1 crore in real estate may have to pay an extra ₹10–12 lakhs for stamp duty, broking fees, and other legal expenses.

According to a 2023 JLL report, the unsold housing inventory in India’s major cities is at an all-time high, signaling potential stagnation. Moreover, the rising interest rates globally have made it more expensive for NRIs to secure home loans, further reducing the attractiveness of real estate as an investment option.

How liquid is your real estate investment? Could you easily access funds in case of an emergency back in your country of residence?

Mutual Funds: Flexible and Data-Backed Returns:

NRIs can diversify their investments across multiple industries and regions using the flexibility offered by mutual funds. The Association of Mutual Funds in India (AMFI) released data indicating that average returns from equities mutual funds in India in 2023 were between 15 and 25 percent. NRIs can invest as little as ₹5,000 per month with systematic investment plans (SIPs), making it possible for even people with little funds.

For example, Aman could have invested ₹1 crore in a mutual fund that tracks the Nifty 50 index. Over the last five years, this investment would have grown at an average rate of 15.48%, leading to significant capital appreciation and his invested amount could have reach out to ₹ 2.05 crore Plus, mutual funds offer liquidity—Aman could withdraw his investment anytime without facing hefty transaction costs.

Furthermore, there are strong tax benefits for NRIs who invest in mutual funds. NRIs can avoid paying taxes twice on their income and capital gains by adhering to the Double Taxation Avoidance Agreement (DTAA). In contrast to the significantly greater tax burden on real estate, the tax rate on long-term capital gains is only 12.5%. Rental income is subject to slab rate taxation, which can exceed a 30% tax level.

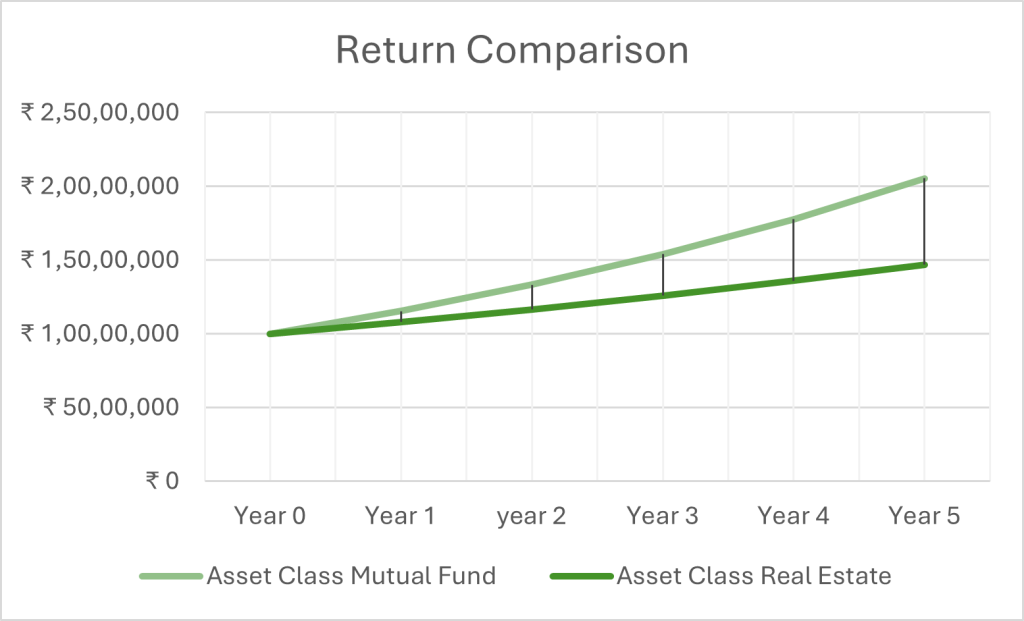

Example: The Data Speaks for Itself

Let’s consider a comparative analysis of the returns on ₹1 crore invested in real estate versus mutual funds over the last five years. According to AMFI data, equity mutual funds have offered an average return of 15.48%. Meanwhile, property prices in cities like Delhi, Chennai and other metro cities have seen only a 6-8% annual appreciation. We must also factoring in the transaction costs, maintenance and property taxes in the real estate.

| Time Frame | Asset Class | |

| Mutual Fund | Real Estate | |

| Year 0 | ₹ 1,00,00,000 | ₹ 1,00,00,000 |

| Year 1 | ₹ 1,15,48,000 | ₹ 1,08,00,000 |

| year 2 | ₹ 1,33,35,630 | ₹ 1,16,64,000 |

| Year 3 | ₹ 1,53,99,986 | ₹ 1,25,97,120 |

| Year 4 | ₹ 1,77,83,904 | ₹ 1,36,04,890 |

| Year 5 | ₹ 2,05,36,852 | ₹ 1,46,93,281 |

Given the data, flexibility, and recent market trends, mutual funds emerge as the more attractive investment option for NRIs in 2024. NRI should ask themselves that “Would you rather lock in your capital for several years with uncertain returns in real estate, or invest in a flexible asset that offers both growth and liquidity?” While real estate may offer emotional satisfaction, it comes with high costs, illiquidity, and lower returns compared to the relatively low-risk, high-return profile of mutual funds.

Platforms like NRI FinOne simplify the process of investing in mutual funds, offering tailored advice that aligns with an NRI’s financial goals and risk appetite.

In the evolving financial landscape, the ability to quickly adapt and manage your investments is crucial. For NRIs looking to maximize their wealth, mutual funds are not only a smart choice but also a future-proof one.

Want to know more about investing in India? Schedule a call with our experts