The aroma of masala chai filled the air as Anika and Kabir, childhood friends reunited in a bustling Mumbai cafe, leaned in over a laptop screen. Anika, now a seasoned NRI living in London for over a decade, had just booked her tickets for a permanent return to India. But beneath the excitement of “Ghar Wapsi” lay a flurry of questions and anxieties.

“So much has changed, Kabir,” she sighed, swirling the remnants of her chai. “Taxes, investments, even bank accounts… it feels like I’m starting from scratch!”

Kabir, a financial advisor based in Mumbai, chuckled knowingly. “It’s a bit like relearning your mother tongue after years abroad, isn’t it? But don’t worry, with a little planning, your financial transition can be smoother than you think.”

This “chai pe charcha” between two friends mirrors the conversations happening in countless NRI households today. Returning to India is a dream for many, but the financial implications can be overwhelming. Let’s break down the key areas you need to address before your flight lands.

1. The Big Question: How Much Money Do I Need?

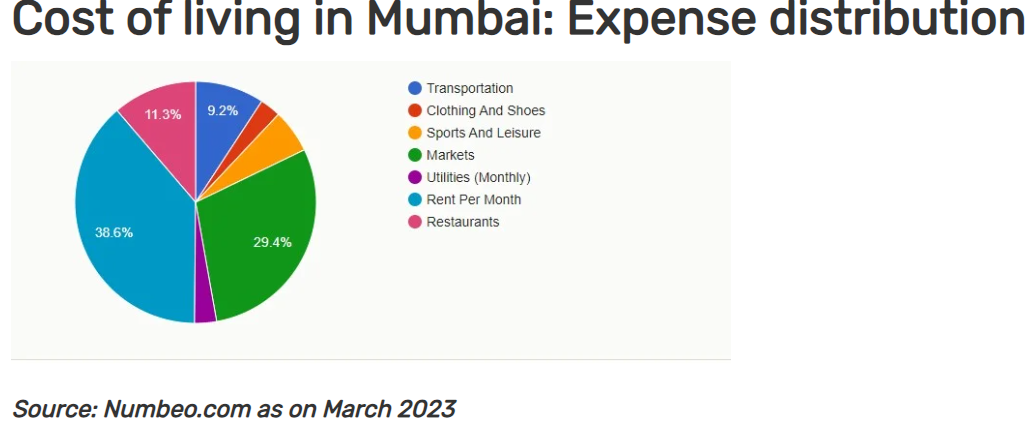

The cost of living in India varies significantly depending on the city, lifestyle, and family size. However, as a ballpark figure, a comfortable lifestyle for a family of two in a metro city like Mumbai or Delhi could range from ₹75,000 to ₹1.5 lakhs per month.

Anika, for instance, estimated her monthly expenses in Mumbai to be around ₹1 lakh, including housing, groceries, transportation and leisure activities.

[Image: Pie chart showing estimated monthly expenses in India]

2. Budgeting for the Big Move: Repatriation Costs

Relocating to India involves several one-time expenses, like:

- Shipping belongings: This can range from ₹50,000 to ₹2 lakhs depending on the volume and distance.

- Visa fees: The cost of obtaining the appropriate visa varies based on your nationality and the type of visa you require.

- Housing deposit: Expect to pay a security deposit equivalent to a few months’ rent.

- Initial setup costs: This includes furnishing your home, buying appliances, and other miscellaneous expenses.

Anika had set aside ₹3 lakhs to cover these repatriation costs, ensuring a smooth transition without financial strain.

3. The Tax Tango: Navigating NRI Taxation

[Image: Tax filing form for NRIs]

Understanding the Indian tax system is crucial for NRIs returning home. The key questions you need to answer are:

- Residential Status: Are you considered a Resident Indian or an NRI for tax purposes? Your residential status determines your tax liability on global income.

- Taxable Income: What sources of income will be taxable in India? This includes income from Indian sources as well as foreign income brought into India.

- Tax Deductions: What deductions and exemptions are you eligible for as an NRI? These can significantly reduce your tax burden.

It’s advisable to consult a tax advisor to understand your individual tax obligations and optimize your tax planning strategies.

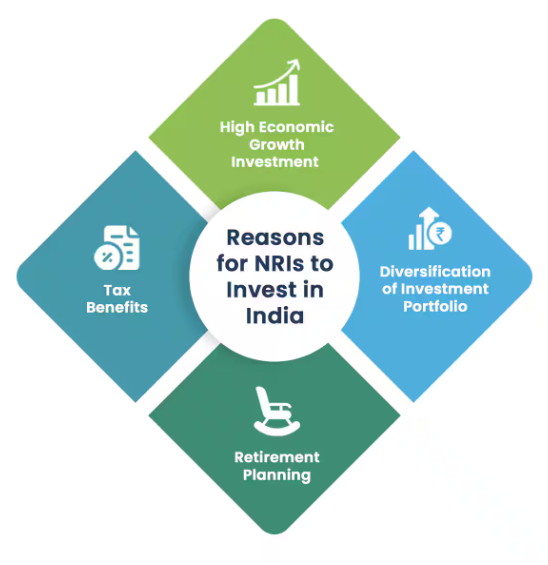

4. Investment Avenues: Where to Park Your Rupees

India offers a plethora of investment options, but choosing the right ones depends on your risk tolerance, financial goals, and investment horizon. Some popular options include:

- Fixed Deposits (FDs): A safe option for steady returns.

- Mutual Funds: A diversified approach to investing in different asset classes.

- Real Estate: A potential for high returns but also involves risks.

- Stocks: Direct investment in companies for potential capital appreciation.

- National Pension System (NPS): A retirement savings scheme with tax benefits.

Kabir advised Anika to create a diversified investment portfolio that aligned with her risk profile and long-term goals.

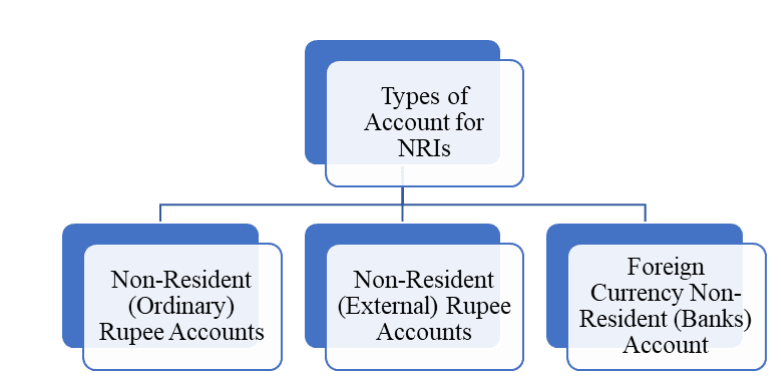

5. Bank Accounts: NRE or NRO?

NRIs can hold two types of bank accounts in India:

- Non-Resident External (NRE) Account: This account is for depositing your foreign earnings and offers tax-free interest. The funds in an NRE account are fully repatriable.

- Non-Resident Ordinary (NRO) Account: This account is for managing your income earned in India, like rent or dividends. The interest earned on an NRO account is taxable.

- Foreign Currency Non Resident Banks (FCNR) Account: If Anika wishes to maintain a Fixed Deposit Account in India, she can opt for an FCNR Account that allows you to save money earned overseas in Foreign Currency.

Anika decided to maintain both NRE and NRO accounts to manage her finances effectively.

Conclusion: The Sweetness of Preparedness

As Anika and Kabir finished their chai, a sense of clarity had replaced her initial anxiety. By discussing her concerns, setting a budget, and understanding her financial obligations, she felt empowered to embark on her new chapter in India.

Returning to India is an emotional journey, but it’s important to approach it with financial preparedness. By addressing the key areas outlined in this “chai pe charcha,” you can ensure a smooth transition and set yourself up for financial success in your homeland.

Remember: This is just a starting point. Always consult with financial and tax professionals for personalized advice tailored to your specific situation.