Recently the Indian Rupee (INR) has been falling to record lows in relation to the US Dollar (USD) with its greatest loss occurring in October 2024. Thanks to substantial outflows from India’s equities markets, rising oil prices and instability in the global economy, the INR dropped to 84.17 per USD, surpassing its previous low. Businesses and consumers alike are concerned about this ongoing fall but it also offers special opportunities for Indian nationals living abroad i.e. NRIs and OCIs.

Reasons Behind the Fall

Several macroeconomic factors have contributed to the fall of the rupee:

- Strong Dollar: The dollar has been stronger as a result of the US Federal Reserve’s aggressive interest rate policy. The demand for the USD rises as international investors seek out bigger profits in the US when the Fed hikes interest rates to combat inflation.

- Crude Oil Prices: India is under more pressure as a result of its net oil imports, which are rising. India imports more than 80% of its Oil needs. Increased need for dollars to fund imports results from increasing oil costs which enlarge India’s trade imbalance and devalue the Indian rupee.

- Capital Outflows: The rupee’s depreciation has been exacerbated by foreign investors withdrawing money from Indian equities markets. Investors are moving their wealth to the US due to rising US bond yields because they believe the country offers superior returns. So far, FII/FPI withdraws more than Rs 40,000 Cr. from the Indian Equity.

- Geopolitical Uncertainties: The rupee’s strength is further weakened by global uncertainties due to the ongoing tensions between Israel and Iran. There is uncertainties as experts believe that the war will leads to further deteriorate the Global Supply chain.

Impact of a Weak INR

The rupee’s decline has both positive and negative consequences for different sectors of the economy, as well as for individuals, especially NRIs.

Negative Impacts:

- Expensive Imports: Businesses that depend on imported equipment, supplies, and items may have to pay more for inputs, which could reduce their profitability and possibly impede industrial output.

- Travel & Education Abroad: As their INR savings now buy fewer dollars, Indians studying or traveling abroad must pay more for tuition, housing and other living expenses.

Positive Impacts:

- Export Boost: Indian exporters profit from a weaker rupee as their products become more competitive on the international market. India’s trade balance will benefit from increased profitability in industries like IT services, pharmaceuticals, and textiles.

- Improved Remittance Value: Better exchange rates will help NRIs remit money to India. Since more rupees may now be obtained for the same amount of foreign currency, NRIs are encouraged to send greater remittances.

Rupee V/s Currencies of top economies

INR v/s USD – 18.25% absolute and 3.65% CAGR

INR v/s Yuan – 18.6% in absolute and 3.6% CAGR

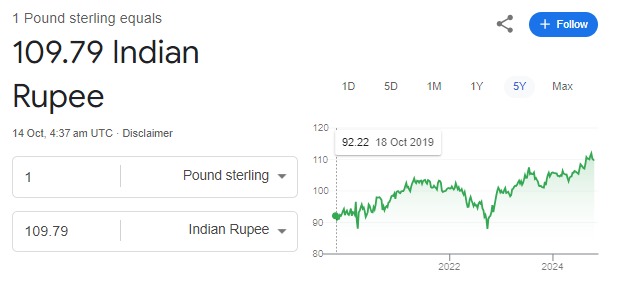

INR v/s GBP – 19.01% absolute and 3.8% CAGR

INR V/s Yen – 13.8% absolute and -2.77 CAGR

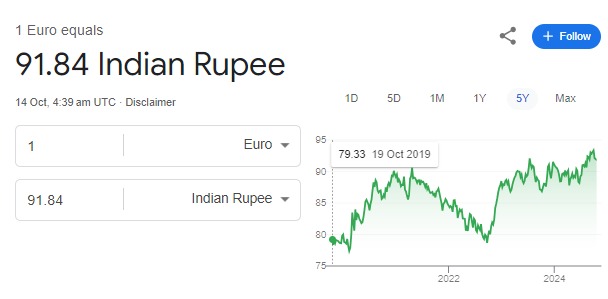

INR v/s Euro – 15.77% absolute and 3.15% CAGR

The depreciation of the Indian Rupee against the USD and other currencies doesn’t necessarily weaken India. It is influenced by various factors, including macro and microeconomic conditions, geopolitical scenarios, foreign reserves, global and local currency demand and supply, and the central bank’s monetary policies, among others.

For NRIs, this is an excellent opportunity to remit money to India, invest, and build assets here—especially if they don’t plan to repatriate the funds back to their home country. The current currency dynamics make India an attractive destination for long-term investment.

Opportunities for NRIs

For NRIs, the rupee’s depreciation presents both opportunities and challenges, particularly in the areas of investment, spending and remittances.

1. Investment Opportunities:

This is the best opportunity for NRIs to invest in Indian assets like equities, Bonds and Mutual Funds. Due to the devaluation, NRIs can purchase more value Indian assets for comparatively less money because foreign cash can now be stretched farther. For example, NRIs can purchase more rupee from the same amount of dollar.

2. Remittances and Savings:

NRIs can send more money to India to take advantage of the favorable currency rates, whether for investments, personal savings, or supporting family members, as a result of the rupee’s decline. The value of remittances will rise, giving receivers in India more spending power.

3. Spending and Transfers:

The present exchange rate will help non-resident Indians (NRIs) who move money or spend in India regularly, enabling them to maintain a higher quality of life or more easily meet their financial responsibilities.

Conclusion

The rupee’s decline against the dollar presents a mixed picture, with inflationary pressures and import costs weighing down the economy while providing opportunities for exporters and NRIs. For NRIs looking to invest, transfer money, or spend in India, this is an advantageous moment, but caution is advised due to potential currency volatility and inflation. Understanding both the risks and benefits will help NRIs make informed decisions in the current economic climate.